DeFi is an acronym for Decentralized Finance. It is used for Cryptocurrency and Blockchain. The goal is to get rid of financial intermediaries.

Reminder: Centralized Finance

Over the years people have depended on traditional financial institutions for all transactions. The traditional financial institutions also known as Centralized financial systems include banks, insurance, stock markets and many other financial institutions that have a central authority that makes decisions for the institution. Centralized financial systems have always required trust through the reputation of intermediaries and the presence of insurance in case one fails to honor the contract.

Centralized financial systems being under central control whether a company or an individual, restricts and follows everything happening in the financial market. There may be hidden costs that tend to add extra fees to the users. These centralized financial systems normally use ledger books stored in the traditional way making transactions slow. Corruption and mismanagement of funds around the system of centralized financial systems have been rampant. Government control is very key in running these institutions.

What is DeFi? To remove the intermediaries

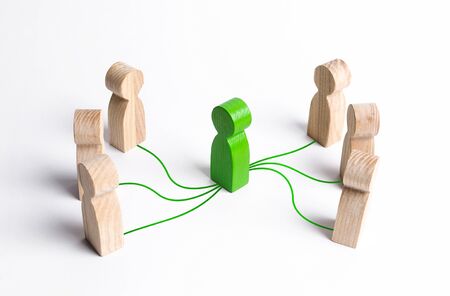

Decentralized Finance or DeFi, is a finance system that is free from a central authority. It eliminates intermediaries mostly the traditional financial systems for transactions. Decentralized finance is the solution to the problems that centralized financial institutions have faced. These problems include the speed of transactions and the fees required per transaction. Decentralized finance is open to everyone, unlike traditional financial systems that require to meet certain rules.

DeFi came to remove the intermediaries that were a requirement in the financial market. DeFi is permissionless and trustless in the financial market. It achieves being permissionless and trustless by heavily depending on cryptography, blockchain system and Smart Contracts.

Smart Contracts to replace the human factor

Smart Contracts are the building blocks in any DeFi transaction. A Smart Contract is a code that is executed automatically when a certain command is made. For example, a command to deduct 10 Ether when someone buys something on the Ethereum blockchain. Being automatic, they are trustless and secure, they just execute after a given command. Therefore, they do not need a centralized verification point. Smart Contracts, therefore, can receive, send and store funds. They are replacing the human factor which is prone to mistakes.

Smart Contracts use the information on the blockchain, it may also use oracle but all the information has to be trusted before the Smart Contracts can execute anything. They are written in a programming language called Solidity. Smart Contracts are immutable meaning they cannot be modified once executed.

Decentralized finance performs many roles in the decentralized cryptocurrency world. These roles are; Stable coins, which are normally created with Smart Contracts and incentives. These coins are what are used to make quick payments and they can be converted to fiat money. Stable coins are normally pegged to a dollar without having a real dollar, an example of stable coins is DAI and USDT.

What is DeFi? Dapps & Decentralized exchanges

Decentralized finance allows borrowing and lending. Compound is one of the Dapps that have invested so much in this category. It allows users to supply assets such as Ether and make interest.

DeFi is also used for decentralized exchanges. This is where crypto assets are exchanged in a decentralized and permissionless way without reducing the value of the coin. Such decentralized exchanges can be done on Uniswap and Loopring.

Derivatives are contracts that derive their value from the performance of any underlying assets such as gold and silver. Decentralized finance performs this activity with SYTHENTIX as an example of companies offering users exposure to different assets. Oracles are part of the DeFi ecosystem, their role is providing reliable data from the outside world into the Smart Contract. Chainlink is a popular app in Oracle.

You can increase your position in a certain asset using borrowed funds, this is called margin trading. It is also used in forex trading where a trader uses margin to trade a large position with a small percentage of funds on their account. Decentralized finance does this by apps like Fulcrum. Insurance can also be used on the DeFi ecosystem. They offer a certain guarantee in compensation to users for payment of a premium. They perform similar roles as traditional insurance companies by protecting users from Smart Contracts failures and protecting users’ deposits. Nexus Mutual is a popular Dapp in this category.

We hope you like this content about DeFi. Feel free to share it around you and to post a comment.

To learn more about the new trend of NFTs that are part of DeFi, read this article.

You will surely like our other articles on the main information about cryptocurrencies, for example: “discovering mining“, “understanding what a whale is“, “exploring Social Token“, and looking into what is a “Fiscal paradise“

This article is not investment advice. Do your own research before investing in the cryptocurrency market.