Binance Futures is the leading cryptocurrency futures trading platform with leverage up to x125. It allows you to open Long positions (upward bets) and Short positions (downward bets).

Allowing very rapid gains but also equally rapid losses, Binance Futures leverage should be used sparingly and knowing the risk of liquidation of your position.

The advantages of Binance Futures are being able to: bet against the market, put leverage to increase your earnings, hedging which means to take 2 opposite positions to hedge.

The disadvantages of Binance Futures are: high risk, market volatility, periodic fees, squeezes i.e. very low volatility followed by an explosion of volatility.

We advise you to use the Wall Of Traders Smart Trading Terminal which is much simpler and much more powerful than the one of Binance Futures. And it is 100% free.

Chapters

Why use the Wall Of Traders Trading Terminal to trade on Binance Futures? Creating an account and transferring funds to Binance Futures Open a Binance Futures account Differences between USDT-Ⓜ Futures and COIN-Ⓜ Futures Transfer funds from Binance Spot to Binance Futures Creating an API key on Binance Futures Placing a Trade on Binance Futures First steps Minimums and Fees Leverage Liquidation Cross and isolated margins Examples of cross and isolated margins

Why use the Wall Of Traders Trading Terminal to trade on Binance Futures?

With Wall Of Traders, you will be able to:

- Put multiple Take Profit to gradually secure your earnings

- Put a Stop Loss

- Add a Trailing on Take Profit and Stop Loss to make them rise in Long mode and lower them in Short mode, this allowing you to optimize your gains and take advantage of bull runs and bear runs

- Set a Trigger or Threshold to enter a trade at a given time: for example when a Resistance or Support is broken

- Set a Timer to automatically cancel or sell a Trade on the market after a defined time

- Draw chart figures on the integrated TradingView graph

- Modify, Cancel or Panic Sell a Trade in one click

- See the maximum trade loss and the Reward / Risk ratio

- Receive a Telegram notification for each Entry, Take Profit or Stop Loss made

- Automatically copy each Trade from the top Traders who use Binance Futures

- Create your own Trading group so that your subscribers or friends can automatically copy your Trades, even if they are not in front of their screen

Creating an account and transferring funds to Binance Futures

Open a Binance Futures account

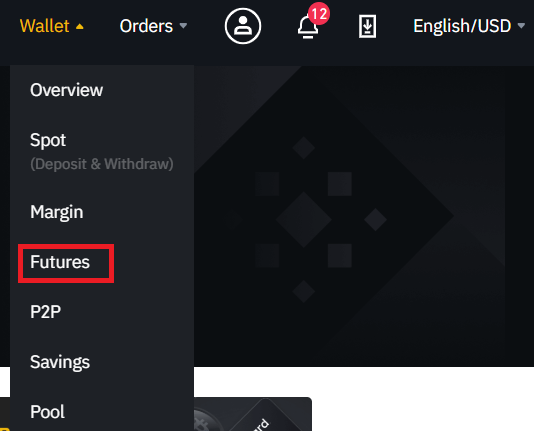

Log into your account on Binance.com and click on the top left on “Wallet” then on “Futures“:

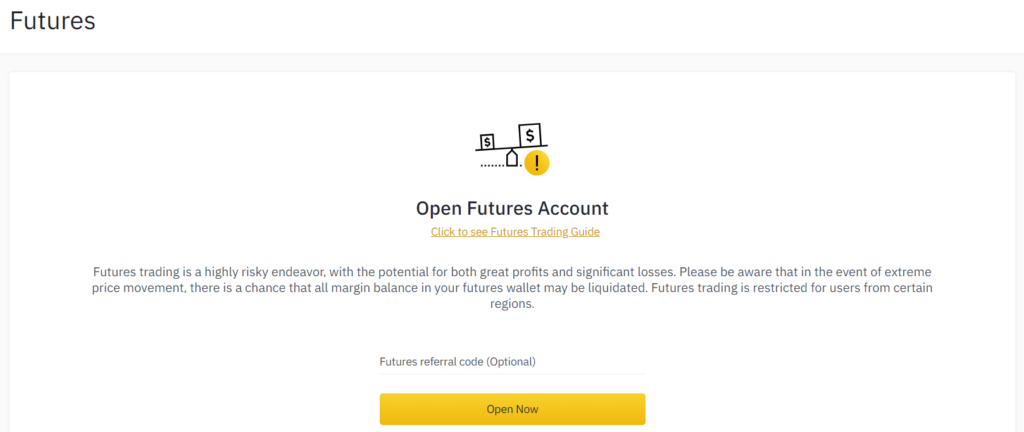

To benefit from Wall Of Traders’ Free Smart Trading and Free Copy Trading, you must not enter a referral code. In fact, not putting a referral code is like putting the Wall Of Traders referral code.

Any trade starting from Wall Of Traders on a Binance or Binance Futures account created without a referral link earns us a fee. It is thanks to this partnership with Binance and Binance Futures that we can offer you all our Trading tools for free! The fees do not change whether you trade directly on Binance Futures or from Wall Of Traders.

Then click on “Open now”:

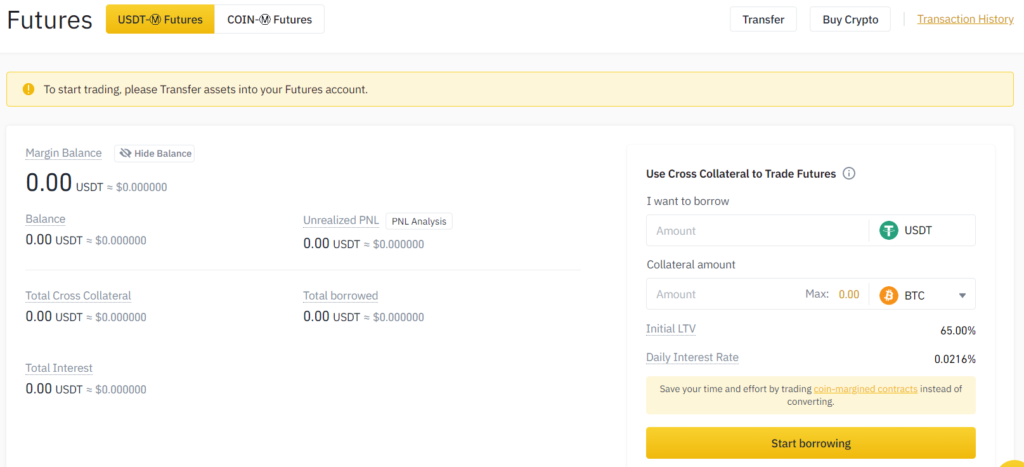

That’s all ! Your Binance Futures account has been created. By default, Futures USDT-Ⓜ is selected:

Differences between USDT-Ⓜ Futures and COIN-Ⓜ Futures

Binance Futures offers 2 types of futures contracts.

USDT-Ⓜ Futures:

- Trading cryptos against the USDT

- Perpetual contract: no expiration

COIN-Ⓜ Futures:

- Trading cryptos against the USD

- Perpetual or quarterly contract: no expiration or expires after 3 months (your choice)

Wall Of Traders only trades on the USDT-Ⓜ Futures account.

Transfer funds from Binance Spot to Binance Futures

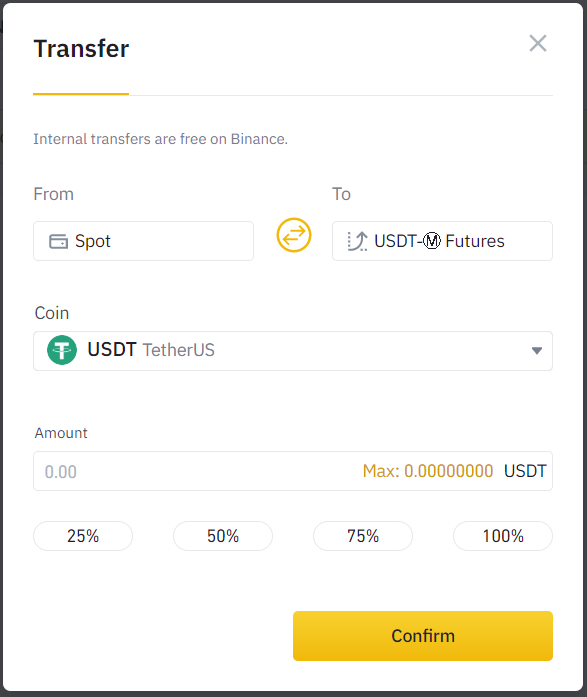

To transfer funds, click on “Transfer” at the top right. You can leave the fields as default and just fill in the amount in USDT you want to transfer. You can only transfer USDT or BNB. Click on “Confirm” to complete the transfer:

Well done ! Your Binance Futures account has been credited. Now let’s link our Binance Futures account to Wall Of Traders in order to benefit from free Smart Trading and Copy Trading tools.

Creating an API key on Binance Futures

Follow this link which will redirect you to the API key creation form on Binance Futures. You can also access it by hovering the mouse over the user icon at the top right, and clicking on “API management”.

At the top in the “Give a title to the API key” field, enter the name you want to give to this API key, for example “Binance Futures Wall Of Traders”. Click on “Create”.

Enter the requested double authentication code and the code received by email.

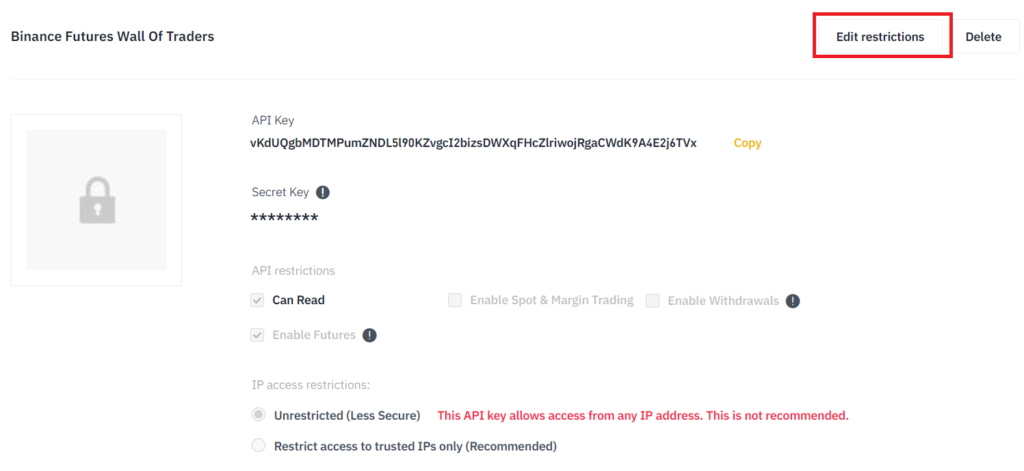

The API key has been created. You must now click on “Modify restrictions” to authorize trading on futures contracts:

Check “Read only” and “Activate futures contract” BUT NOT “Activate withdrawals”. To allow Wall Of Traders to place orders, “No restriction” must also be checked.

The two important data to copy are “API Key” and “Secret Key”. These are the two codes that you will paste into the fields on the Add Binance Futures Exchange page to your Wall Of Traders account.

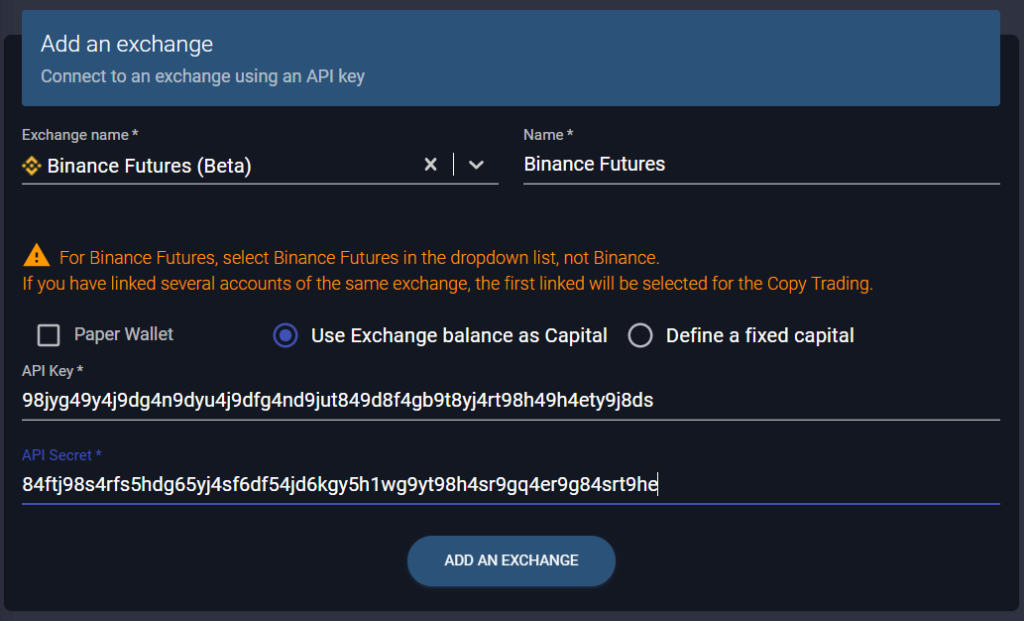

To add Binance Futures to Wall Of Traders, open this link, select Binance Futures from the drop-down list, enter the API key and secret API key, and click ADD AN EXCHANGE:

To go further in the configuration of your Wall Of Traders account, we advise you to read the article “How to set up your Copy Trading and Smart Trading account?” whose link is at the bottom of this article.

Then all that remains is to place a Trade on Binance Futures. Let’s see this.

Placing a Trade on Binance Futures

First steps

Now that we’ve created a Binance Futures account, transferred funds, and linked the Exchange to our Wall Of Traders account, let’s see how to place a Trade.

Go to Wall Of Traders Smart Trading.

In the “Account Name” field, select the Binance Futures Exchange you just linked to Wall Of Traders. Also choose the pair to trade.

Select “BUY / LONG” if you want to enter a long position, ie if you think the price will go up.

Select “SELL / SHORT” if you want to enter a short position, ie if you think the price will drop.

To learn how to use the Wall Of Traders Smart Trading Terminal in detail, we advise you to read the Smart Trading Tutorial, whose link is at the bottom of this article. It works the same on any exchange. The only difference on Binance Futures is the presence of a new field: Leverage. We detail it in the following section.

Binance Futures: Minimums and Fees

The minimum on Binance Spot to place a trade is $ 10. On Binance Futures, the minimum is 0.001. If Bitcoin is at $ 10,000, that represents a trade of $ 10. If Ethereum is at $ 400, that represents a trade of $ 0.40. So the minimum dollar amount varies greatly depending on the crypto traded.

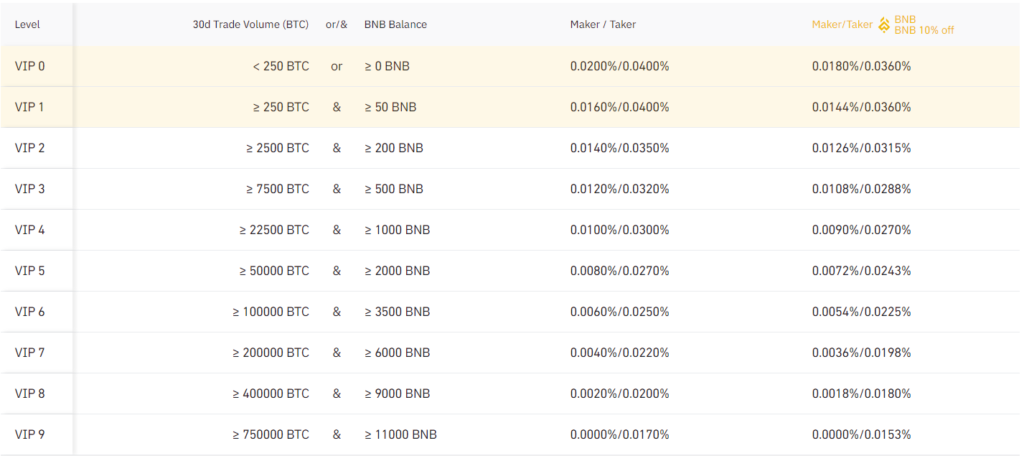

The fees are 0.04% for market orders and 0.02% for limit orders. They decrease the more you trade: starting at 250 BTC of trading volume per month and owning at least 50 BNB, as you can see below. Also, if you have BNB to pay the fees, they drop another 10%.

Another type of charge to consider are periodic finance charges. Every 8 hours, all your current positions generate relatively low variable fees. They can be viewed on this Binance link.

Leverage

Leverage is all about borrowing money from the Exchange like Bitstamp, but it’s transparent to you. You just need to choose a level of leverage on Wall Of Traders Smart Trading and increase your position accordingly.

Each percentage increase or decrease in the price will be multiplied by this leverage for your current position.

Let’s take an example to quickly understand. If you leverage x5 and buy 500 USDT of Bitcoin, you are actually only using 500/5 = 100 USDT from your wallet. A variation of 2% will therefore be a variation of 2% on 500 USDT, ie a variation of 10 USDT. On your 100 USDT in your portfolio, this represents a change of 10%, up or down.

So we see that the greater the leverage, the faster the gains or losses are realized.

Liquidation

On classic Binance Spot, there is no liquidation because there is no leverage. However, we can still consider a liquidation: when the price drops by 100%, you have lost your entire position.

On Binance Futures, you can also lose your entire position, but this loss is faster the greater your leverage level.

Let’s go back to our previous example. We had bought for 500 USDT of Bitcoin in leverage x5 with a stake of 100 USDT. If the Bitcoin price drops by 20%, your drop is really 20×5 = 100% and you lose your 100 USDT entirely. If the price goes up soon after, you do not benefit because you were taken out of the position: you were liquidated.

It is in order not to be liquidated too quickly that you must be very careful with leverage. The maximum leverage allowed by Binance Futures is x125. Therefore, a drop of 0.8% will make you lose your entire position!

NB: In our two previous examples, liquidations will occur slightly before the 20% and 0.8% declines because Binance Futures applies liquidation fees.

Liquidation occurs in BUY / LONG mode when the price drops too much.

Liquidation occurs in SELL / SHORT mode when the price rises too much.

Cross and isolated margins

The isolated margin takes into account only the considered trading pair to calculate the liquidation.

The cross margin takes into account all the trading pairs that you have in a position, regardless of the pair.

In cross margin you will therefore be liquidated later, since the collateral, which is the quantity of cryptocurrencies in position, is greater than in the isolated margin. On the other hand, in cross margin all the positions will be liquidated at the same time. This margin is rather to be used in long-term strategies, in order to resist strong market variations.

In isolated margin, liquidation will only apply to the pair considered. You will only lose funds on the liquidated pair, not on other pairs. As you will be less resistant to strong market declines, this margin is more suitable for short-term strategies.

To change the margin mode, go directly to Binance Futures to change it.

Examples of cross and isolated margins

Let’s take an example. You bought 100 USDT of Bitcoin with x20 leverage and 100 USDT of Ethereum with x20 leverage as well. So you have the equivalent of 2000 USDT of BTC and 2000 USDT of ETH in position.

In isolated margin, if Bitcoin loses 5% of its value, you lose 5% of 2000 USDT or 100 USDT and you are liquidated on the BTC-USDT position: you lose your initial 100 USDT. But your Ethereum of 100 USDT is still in position.

In cross-margin, if Bitcoin loses 5% of its value and Ethereum does not move, you lose 5% of 2000 USDT or 100 USDT. But since the margin is cross, your collateral is 200 USDT. You are not liquidated. You will have to wait for a 10% drop in Bitcoin for your 200 USDT of collateral to be reached and for your two positions BTC-USDT and ETH-USDT to be liquidated. A 5% drop in Bitcoin and 5% drop in Ethereum will also liquidate both of your positions.

Well done! You now know how to create an account on Binance Futures, transfer funds to it, and trade with leverage.

Share it with others and support us by sharing it on the social network of your choice using the buttons below.

You can also share it with all your contacts who would like to discover Binance Futures.

To meet other Traders or to ask us for help, join the English speaking Wall Of Traders community on Telegram.

Write a comment to share your experience, we will answer all your questions.

Conclusion

In conclusion, Binance Futures offers a comprehensive platform for traders to engage in bitcoin futures trading and take advantage of the opportunities presented by futures contracts. With the ability to open both long and short positions, traders can effectively speculate on the price movements of the underlying cryptocurrency.

By utilizing leverage trading, traders can amplify their potential earnings, but it is crucial to understand the risks involved, including the potential for rapid losses and the risk of liquidation. It is recommended to use leverage sparingly and with a clear understanding of the market volatility and funding fees associated with futures trading.

The Wall Of Traders Trading Terminal provides a simplified and powerful alternative for trading on Binance Futures. With its user-friendly interface and advanced features, traders can easily navigate the complexities of futures trading while benefiting from the platform’s free-of-charge services.

To start trading on Binance Futures, traders need to create a futures account, transfer funds from their Binance Spot account, and generate an API key for seamless integration. Understanding the differences between USDT-ⓂFutures and COIN-ⓂFutures, as well as the concepts of cross and isolated margins, is essential for successful trading.

When placing trades on Binance Futures, traders have the flexibility to choose between market orders and limit orders, allowing them to enter positions at the current market price or specify their desired entry point. Additionally, implementing take profit levels is crucial to secure earnings when the price reaches a predetermined target.

Monitoring metrics such as open interest, the last price, and total cost provides valuable insights into market trends and trading performance. By carefully managing their positions, traders can optimize their strategies, whether they are taking short positions or long positions.

In summary, Binance Futures offers a robust platform for trading bitcoin futures, providing opportunities for profit through leverage trading and the ability to bet against the market. However, traders should exercise caution, understanding the risks and market dynamics associated with futures trading. With the right knowledge, strategy, and the support of tools like the Wall Of Traders Trading Terminal, traders can embark on their futures trading journey on Binance with confidence.

To know more :

You could be interested on How to do Copy Trading and Smart Trading for Free on Binance?, or by How to set up your Copy Trading and Smart Trading account?, or even by The 4 free Crypto Trading tools, finally by the complete tutorial on the Smart Trading.

This article is not investment advice. Do your own research before investing in the cryptocurrency market.