Introduction

When you hear about Traders, their Trading vocabulary seems very technical. However, the number of main concepts to learn Trading is easily understood. To fully understand how to do Crypto Trading or any other type of Trading, an explanation of this vocabulary is necessary.

This vocabulary is the same on all types of financial assets: cryptocurrencies like stellar, stock market assets, forex, cfd, stocks, bonds …

If you are a beginner, this article is a great place to start and learn Trading. It will also be suitable for more seasoned Traders who want to know other more advanced concepts because they do not exist in the Trading interfaces of the main Exchanges, but present on the Wall Of Traders Trading platform.

These Trading tools allow you to further secure your transactions as a Trader and Investor. Learn Trading starts with knowing what can be done with a trade.

The best crypto trading platform

If you want to apply these concepts of Trading in the cryptocurrency market, we have developed Wall Of Traders.

It is a very intuitive Crypto Broker and advanced social trading platform that will make you practice the main concepts to learn Trading.

In addition, it is 100% free thanks to our entry into the Binance Broker Program. It contains 4 tools:

- A Smart Trading Terminal to place simple or very advanced orders on the main crypto exchanges (Binance, Binance Margin, Binance Futures, Kraken, Bittrex, Huobi …).

- A Copy Trading Bot to copy the best Traders who have had very good results.

- A Portfolio to follow all your cryptocurrencies in one place.

- A Telegram Notifications Bot to be notified in real time on your Smartphone of orders reached and profits or losses made.

Good learning !

Chapters

Take a position Pair Buy / Long Sell / Short The three order levels Entry Take Profit (TP) Stop Loss (SL) Example Order types Limit Order Market order OCO Orders (Order Cancels Order) The Trailing Trailing Entry Trailing Stop Trailing Take Profit Other notions of Trading Trigger Panic Sell Reward / Risk Ratio Leverage

Learn Trading: Take a Position

Pair

A pair is a set of two assets. You can buy or sell one asset with another. Pairs are the basis of every trade.

For example, buying on the BTC-USDT pair is buying BTC with USDT, which is selling those USDTs. It also works the other way around: selling on the BTC-USDT pair is selling BTC by buying USDT.

The price of a pair varies over time and varies from Exchange to Exchange. Trading charts are exactly that: bice evolution of the pair over time on a specific Exchange, with graphical visualization according to the chosen timescale.

This price varies depending on several elements such as:

- the volume, which is the quantity exchanged at a time t.

- liquidity, i.e. the quantity available at a time t.

- the order book, i.e. the quantity and prices offered by buyers and sellers.

Buy / Long

Buying is buying a pair and wanting to sell it for more. In Futures Trading, we say “to be Long” or “to take a Long position”. For simplicity, the term Long can be used on all types of market.

The buyer will seek to buy as low as possible to enter a long position on the pair.

We’ll come back to order types later in this article, but here’s an overview of what the buyer can do:

- He thinks the price is right and he immediately buys at the market price.

- Or he thinks the price will go down and he places a limit order lower than the market price.

- He can place a Trailing to cause his buy price to fall.

- He can place a Trigger to buy at a specific level.

Sell / Short

Selling is the act of selling on a pair while wanting to buy back cheaper. In Futures Trading, we say “to be Short” or “to take a Short position”. For simplicity, the term Short can be used in all types of market.

The seller will try to sell as high as possible to enter the short position on the pair.

We’ll come back to order types later in this article, but here’s an overview of what the seller can do:

- He thinks the price is right, and he immediately sells at the market price.

- Or he thinks the price is going to go up and he places a limit order higher than the market price.

- He can place a Trailing to make his selling price move upwards.

- He can place a Trigger to sell at a specific level.

Learn Trading: The Three Order Levels

A Trade is generally made up of:

- Mandatory : an Entry order.

- One or more Take Profit (TP) order(s).

- A Stop Loss (SL) order.

Below, we go into detail about each of these levels, and then we’ll give you an example.

Entry

The Entry is the first order to be executed. To learn Trading, you have to master this concept, which is essential.

In Buy mode, you will buy a pair, and therefore place a buy order.

In Sell mode, you start by selling the pair if you think its price will drop, and therefore place a sell order.

You define the share you want to buy or sell. It can be defined either:

- in quantity, for example to buy 1 Ethereum.

- as a percentage, for example sell on that pair 3% of the Capital you own on the Exchange.

On an Entry, you can put a Trailing (see below), a Trigger (see below) or a Timeout. Putting a Timeout means specifying the date / time on which the Entry must be canceled if your desired buy or sell price has not been reached.

Take Profit (TP)

The Take Profit is triggered only if the Entry has taken place. Also called Target, this is your goal to exit the trade. If you bought as Entry, your goal is to resell more at Take Profit. If you sold in Entry, your goal is to buy back cheaper at Take Profit.

You can put more than one Take Profit. For example you can decide to sell 60% of the bought asset when 5% profit has been made, and sell the remaining 40% when 7% profit has been made.

On a Take Profit, you can put a Trailing (see below).

The Trade is finished when all TPs have been reached or when Stop Loss has been reached.

Stop Loss (SL)

Stop Loss is the maximum loss you can accept before exiting the trade for good. It is important to master this notion in order to properly learn Trading. It’s your seat belt to put on every transaction.

Imagine, you bought 1 Ethereum at 100 USDT and you hope its price will increase to resell for more. You place a Take Profit at 110 USDT.

Unfortunately, the price can drop. You don’t want to wait for the price to drop to 50 USDT to resell, otherwise you will have lost 50% on that Trade!

So to cover your trade, when buying at 100 USDT, you placed a Stop Loss at 97 USDT. If the market hits this price before reaching your Take Profit, you will go back to 97 USDT with a moderate loss of 3%.

On a Stop Loss, it is possible to place a Trailing (see below). It is also possible to put a Timeout on the Stop Loss, in order to specify the date / time at which we must sell everything and exit the Trade.

Example

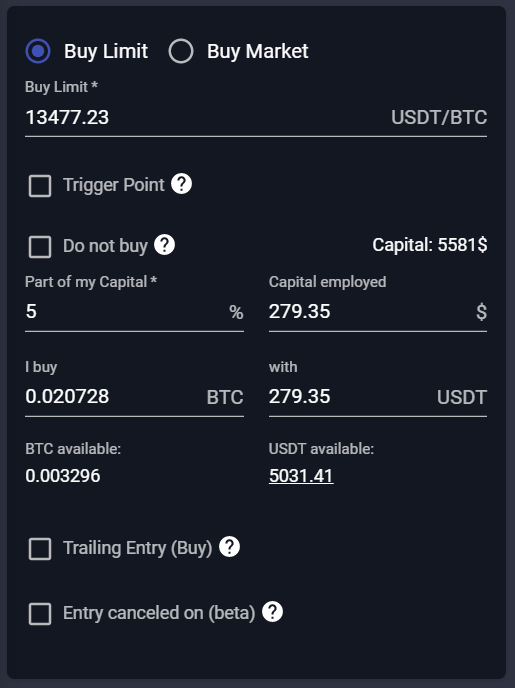

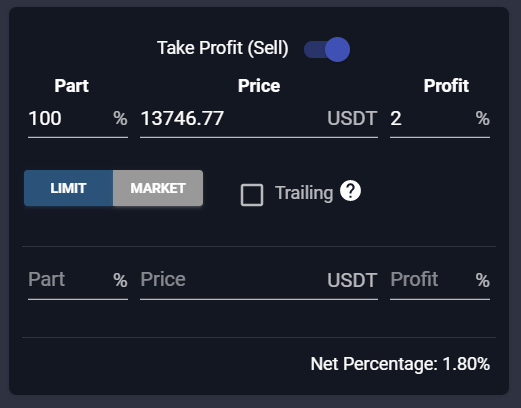

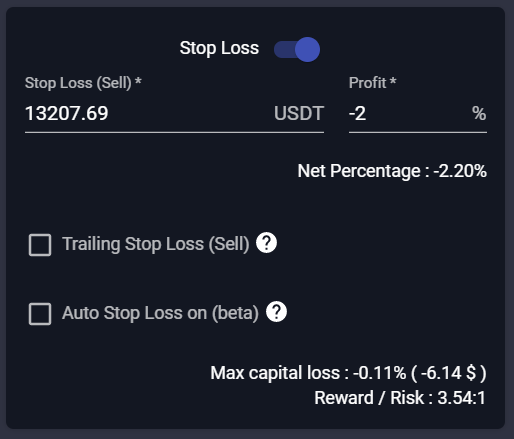

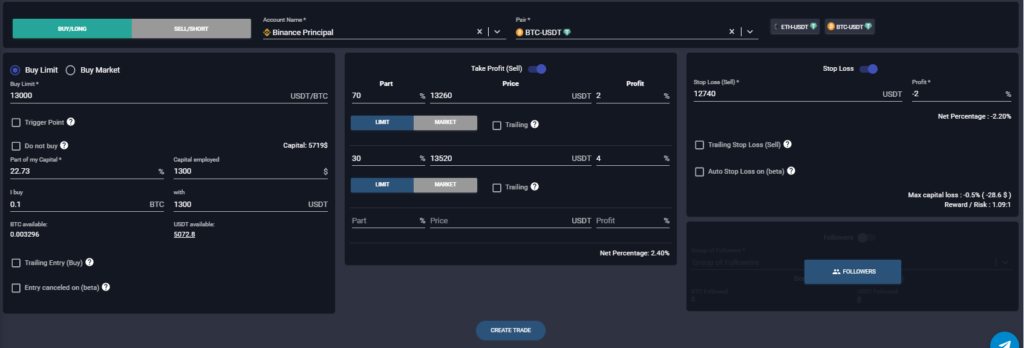

If I buy 0.1 BTC at 13,000 USDT with a first Take Profit of 13,260 USDT at 70% of my Entry, a second Take Profit of 13,520 USDT at 30% of my Entry, with a Stop Loss of 12,740 USDT, the Trade can be summarized as follows:

- Pair: BTC / USDT

- Entry: 1300 USDT or 0.1 BTC bought at a price of 13000 USDT.

- TP1 (1st Take Profit): 13,260 USDT at 70% or 0.07 BTC sold (profit + 2%).

- TP2 (2nd Take Profit): 13,520 USDT at 30% or 0.03 BTC sold (profit + 4%).

- SL: 12,740 USDT or 0.1 BTC sold (loss -2%).

The gain or loss can be calculated like this:

If TP1 and TP2 are achieved, my gain is 2.6%: (70% * 2% + 30% * 4%).

Otherwise, if the TP1 is reached and then the SL is reached, my gain is 0.8%: (70% * 2% – 30% * 2%).

Otherwise, if SL is hit first, my loss is -2%.

NOT.B. : in the image above, the announced gain is 2.4% and the announced loss is -2.2% because they take into account Binance’s Trading fees which are 0.1% per trade; or 0.2% for a buy and a sell.

Learn Trading: Order Types

Limit Order

A Limit Order is an Order for which you specify the price and for which you do not want to obtain a lower price than this price, even if it means waiting.

For example if the ADA-BTC pair is at 0.000005 but you want to buy at 0.0000045, your order will be completed when the market will actually reach 0.0000045.

Be careful if the ADA-BTC pair is at 0.000005 and you place a buy limit order at 0.0000052, your order will be executed immediately because you are offering a limit price that is more interesting than the market price. Your order will then be executed at the market price, therefore at 0.000005.

On the Sell side, if you put a limit selling price higher than the market price, the Sell will be made when the market will reach this higher price.

On the other hand, a limit Sell lower than the market price will be executed immediately because you are offering to “sell inexpensively”, so the Sell will be made at the market price.

To learn Trading, you must also understand what a Market Order is.

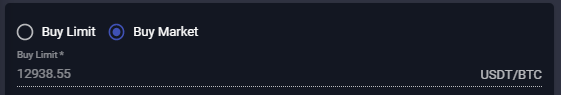

Market order

This is an order for which you do not specify a price. You want to buy (or sell) immediately at the price the market is offering. Don’t wait, your order is executed instantly at the best market price.

The price is grayed out, you cannot change it.

OCO Orders (Order Cancels Order)

It is a combination of two (or more) orders: the first order reached cancels the second order. These two orders therefore depend on each other.

Typically, OCO orders include a Take Profit and a Stop Loss. If the Take Profit is reached, it is executed and the Stop Loss order is canceled. Conversely if the Stop Loss is reached first, it is executed and the Take Profit order is canceled.

OCO orders can be more than two. Imagine, I place 3 Take Profits with the goal of selling 50%, 30% and then 20% of my Entry bought amount. I also place 1 Stop Loss. There are then several scenarios:

- if the SL is reached before the 3 TP, therefore these 3 TP are canceled. The SL sells the entire quantity bought in Entry, i.e. 100%.

- if the TP1 is reached, therefore the 50% share is sold, then the SL is reached, therefore the TP2 and TP3 are canceled. The SL only sells the remaining part, ie 50%.

- if the TP1 and TP2 are reached, then 50% and 30% shares are sold, then the SL is reached, therefore the TP3 is canceled. The SL only sells the remaining part, ie 20%.

- if the 3 TPs are reached, therefore 100% of the shares have been successfully reached, therefore the SL is canceled.

Learn Trading: The Trailing

Trailing is a very powerful function that you can put on Entry, Take Profit or Stop Loss. We just define the number T which is a %.

The goal is to get the best price in the market, moving your position as long as the price is heading in the right direction, and entering a position as soon as the market is heading in the wrong direction by T%. It is always a market order. Trailing is very interesting when there is high volatility.

It’s a confusing feature at first but so powerful! It can really make a difference with other Traders. Learn Trading is also learning to be better than other traders.

Trailing Entry

An Trailing Entry is an Entry Order that automatically follows the market price if it goes in the direction of your buy or sell bet, and that does not move if the market goes in the opposite direction.

Trailing Buy Entry

In Buy mode, the Trailing price is placed above the market price with a deviation of T% that you have defined. If the market price drops, your Trailing price drops by the same amount. If the market price goes up, the Trailing price doesn’t move. The buy is made when the Trailing price is reached by the market.

For example if the market price is 200 and you put a 5% Trailing Buy Entry, the trailing price will be 210.

- If the price goes down to 180, the Trailing price goes down to 189.

- Then if the price goes up to 188, the Trailing price stays at 189.

- Then if the price goes down to 160, the Trailing price goes down to 168.

- Finally if the price rises to 180, the Trailing price of 168 is bought at the market.

In this example, you ended up buying at 168 when the market started out at 200. Your trailing made you buy cheaper.

Trailing Sell Entry

When selling, the Trailing price is placed below the market price with a deviation of T% that you have defined. If the market price goes up, your Trailing price goes up that much. If the market price drops, the Trailing price does not move. The sell is made when the Trailing price is reached by the market.

For example if the market price is 200 and you put a 5% Trailing Sell Entry, the trailing price will be 190.

- If the price goes up to 220, the Trailing price goes up to 209.

- Then if the price drops to 210, the Trailing price stays at 209.

- Then if the price goes up to 240, the Trailing price goes up to 228.

- Finally if the price drops to 225, the Trailing price at 228 is sold to the market.

In this example, you ended up selling at 228 when the market started out at 200. Your trailing made you sell more expensive.

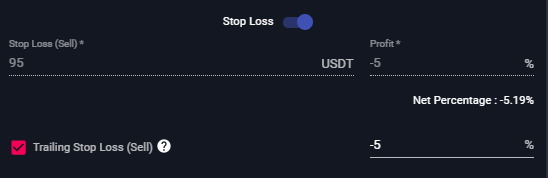

Trailing stop

A Trailing Stop is a Stop Loss Order that automatically follows the market price if it goes in the direction of your buy or sell bet. For example if you buy at a price of 100 and enter a Trailing Stop of 5%, a Stop Loss Order of 95 will be placed to sell.

- If the price goes up to 110, the Stop Order goes up to 104.5.

- Then if the price drops to 105, the Stop Order stays at 104.5.

- Then if the price goes up to 120, the Stop Order goes up to 114.

- Finally if the price drops to 110, the Stop Order at 114 is sold to the market.

In this example, you finally sold at 114 when your Stop Loss was originally at 95. Your trailing made you sell more expensive.

In the same way, you can place a Buy Trailing Stop if your entry was to Sell, in other words if you entered a Short position.

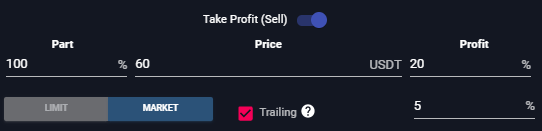

Trailing Take Profit

A Trailing Take Profit is a Take Profit which is converted to a Trailing Stop as soon as the Take Profit price is reached. For example if you buy at the price of 50, place a Take Profit at the price of 60 and a Trailing Take Profit of 5%:

- If the price goes up to 55 nothing happens because the Take Profit of 60 is not reached.

- Then if the price goes up to 60, then a Stop Order of 57 will be placed.

- Then if the price drops to 58, the Stop Order remains at 57.

- Then if the price goes up to 70, the Stop Order goes up to 66.5.

- Finally if the price drops to 60, the Stop Order at 66.5 is sold to the market.

In this example, you finally sold at 66.5 when your Take Profit was originally at 60. Your trailing made you sell more expensive.

In the same way, you can place a Buy Trailing Take Profit if your entry was to Sell, in other words if you entered a Short position.

Learn Trading: Other Trading Notions

Trigger

A Trigger is a threshold to be crossed before the Entry is placed. As long as this Trigger is not reached, the Entry is not placed and the Trade is on hold.

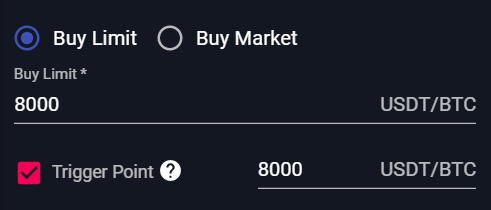

For example if BTC is at 7,500 USDT and I have identified a Resistance at 7,800, I want to buy BTC only if the market breaks that threshold. If I place a Limit Order of 8000, it will execute immediately because it is above the market. So I put a Trigger at 8000 on the BTC-USDT pair on a Market Order or on a Limit Order of 8000.

Another example if ETH is at 180 USDT and I have identified Support at 150, I want to buy ETH when the market reaches that Support. I can directly put a Limit Order of 150, no need to trigger. But if I want to start a Trailing Entry at 150, I put a Trigger at 150 associated with a Trailing.

Panic sell

The Panic Sell is the fact of immediately reselling a Long position on the market.

We will also use the term “Panic Sell” to immediately buy back a short position in the market, whereas it should be called “Panic Buy”.

It’s a one-click manual action. This allows you to exit a Trade before its Stop Loss or Take Profit is reached. On the Wall Of Traders Trading platform, the button in the “My Trades” Menu is as follows:

As soon as the Panic Sell button is clicked, it cancels all the Take Profit and Stop Loss in progress on that Trade, and it sells (in the case of an entry buy) or it buys (in the case of a sell in entry) immediately at market price.

Learn Trading is also knowing that you can exit a Trade instantly.

Reward / Risk Ratio

The Reward / Risk Ratio is for a Trade the maximum gain divided by the maximum loss.

A ratio of 2:1 means you can win twice as much as you can lose.

The maximum profit is the profit realized when the Take Profit is reached, or when all the Take Profit are reached if you have put several.

The maximum loss is the one suffered when the Stop Loss is reached.

Thanks to this Reward / Risk Ratio, you can choose your Take Profit and Stop Loss levels. It is present in the Smart Trading interface of Wall Of Traders in the Stop Loss block. Indeed without Stop Loss, the Reward / Risk Ratio does not make sense because it tends towards zero.

Overall, trading with Ratios below 2:1 is not recommended. So if you put a Take Profit of 4% on a Trade, you should not put a Stop Loss lower than -2%. Some Traders will even prefer Ratios of at least 4:1.

A Trader who trades at 2:1 Ratios will win over the long term if at least one third of his trades are successful. Indeed if it carries out two losing trades and a winner, its final ratio is: -1 (loss) -1 (loss) +2 (gain) = 0 and it is at equilibrium.

Learn Trading: Leverage

Leverage is the possibility to earn more and lose more while risking the same amount. Only some exchanges offer leverage eg Kraken, BitMEX, Binance Margin, Binance Futures.

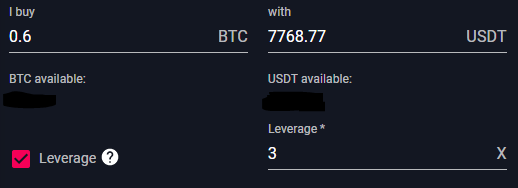

Concretely, if you buy 0.6 Bitcoin on the BTC-USDT pair with x3 leverage, you are actually betting only 0.2 BTC. The Exchange lends you the remaining 0.4 BTC. To use 0.2 BTC with leverage x3, you must enter 0.6 as the quantity and not 0.2:

If the price goes up 5%, you earn 5% of 0.6 BTC or 0.03 BTC. In the end, on your starting bet of 0.2 BTC, you have earned 0.03 BTC or 15% profit.

If the price drops 5%, you lose 5% of 0.6 BTC or 0.03 BTC. In the end on your starting bet of 0.2 BTC, you have lost 0.03 BTC or 15% loss.

We can therefore see with this example that leverage multiplies your gains but also your losses! Leverage is therefore very risky and reserved for advanced traders.

What is liquidation? Liquidation is when the Exchange takes you out of the Trade having lost all of your stake because you can no longer afford to repay the leverage loan. Let’s go back to our previous example:

- Without leverage, if the price reaches 0 (100% drop!), You have lost your starting 0.2 BTC because they are no longer worth anything.

- With Leverage 3 you are trading 0.6 BTC, so if the price drops by 33.33% you lose 0.6 BTC * 33.33% = 0.2 BTC. So with a 33.33% drop, you lose your entire starting bet.

- With 100 leverage (some Exchanges offer it), you trade 20 BTC and your stake of 0.2 BTC would have been liquidated during a drop of … 1%!

Mathematical formula: % drop before being liquidated = 100 / leverage.

We hope that you liked this article and that you see more clearly in these concepts of Trading which can be confusing at the beginning. More profits and less losses, it’s within your reach with these tools!

Share it with others and support us by sharing it on the social network of your choice and sending it to your contacts who may be interested.

Write a comment to share your experience, we will answer all your questions.

To meet the community of English-speaking Crypto Traders, or to ask us for help, join our Telegram group.

To go further in your learning of Trading, we recommend that you read our article on the best technical trading indicators to do Technical Analysis, or the one on Dollar Cost Averaging, or to read how to become a trader for the copy trading by creating your own copy trading group for your friends/subscribers/community.

This article is not investment advice. Do your own research before investing in the cryptocurrency market.