TradingView alert: How to create a trade automatically? In this article we will introduce you to the “Signal TradingView” function present on our Wall Of Traders platform. We’ll also show you how to use it to automate your trade creation from a TradingView alert!

TradingView, a Trading Platform for Technical Analysis

TradingView online platform allows its users to monitor stock and cryptocurrency prices in real time. It also allows you to perform various transactions and analyses. She is well known in the world of Forex trading or Crypto currencies and crypto signals.

On TradingView you can find several charts and many indicators personalized and customizable techniques as you see fit. The site also allows you to develop your own indicators if you have scripting skills.

The platform was established in Westville, USA in 2012 as a base for social commerce. It is for this reason that it also has a social network , that’s what makes it so strong. Which means that it allows beginners or experienced traders to share or exchange their trading analyzes on the dedicated network like Bitstamp.

However, TradingView is mainly used by several other trading platforms. Inasmuch as live stock chart provider principally. On Wall Of Traders for example, where you can directly find the TradingView charts during your trades.

What is a Alert used for?

A Alert is an signal or notification. It allows you to be notified of the evolution of a price, an indicator or a strategy.

Beginners and professionals alike can take advantage of TradingView’s extensive features, which include more than 100 indicators. You are able to create TradingView crypto signals. The point is to be able to analyze the price action of cryptos and test trading strategies. You can therefore create alerts that will notify you when an indicator is reached, for example.

It is set up on TradingView but TradingView does not allow you to create a Trade to a cryptocurrency exchange like Binance. For this, you can use Wall Of Traders thanks to our new feature “ Signal Trading View “. Wall Of Traders will link TradingView and Binance automatically. It allows as well to connect Bybit to Tradingview. Furthermore you will receive immediate notifications on Telegram on a private alert notification channel.

How to use a TradingView Alert on Wall Of Traders?

Prepare your Trade on Wall Of traders

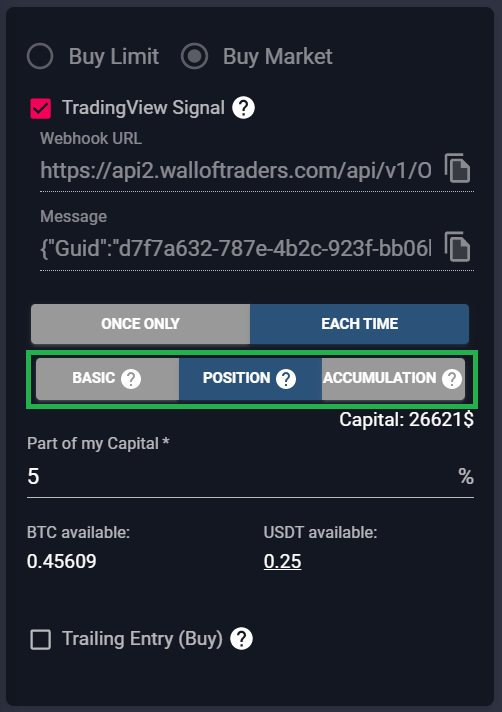

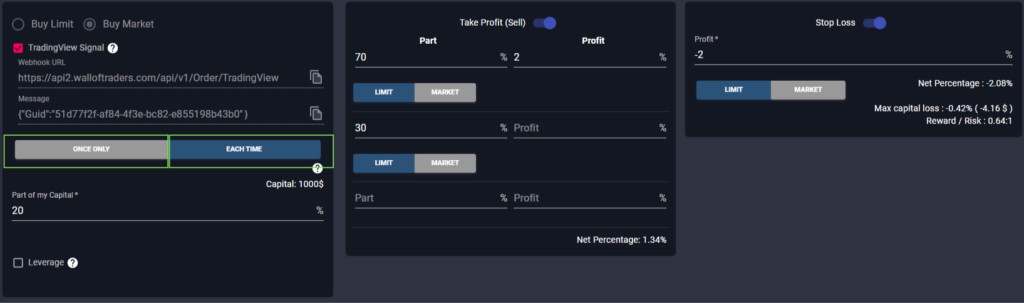

Go to Wall Of Traders in Smart Trading. Click the checkbox “ Signal Trading View “. Prepare your trade or your trading bot with conditions on Entry, Take Profit and Stop Loss.

If you want the TradingView alert to trigger a single trade, click “Once only“. The TradingView alert to trigger a trade each time it is hit, click “Each time”.

If you click “Each time”, you will have the following options:

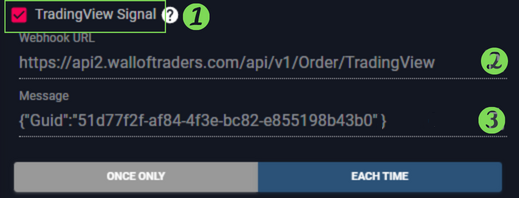

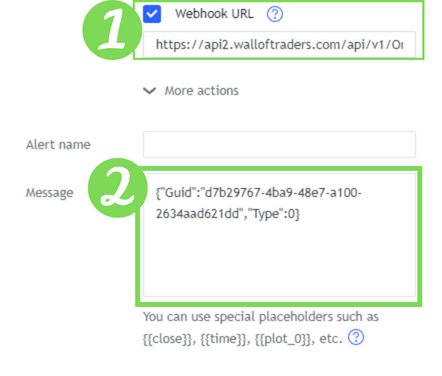

In each of the 3 cases, you will need to copy the URL of the Webhook as well as the Message. But this Message changes depending on the case. Let’s see the 3 different methods.

BASIC: to create a simple trade, triggered by a signal on TradingView

The Message just contains the Guid which is a unique code identifying your strategy:

{"Guid":"e168353f-48d1-4eb9-83ba-d5064099c7d5"}Each time TradingView receives the alert you created, TradingView will send Wall Of Traders the action to trigger that trade. The position size will be the one defined on Wall Of Traders.

POSITION: to create a trade with a specific position quantity, triggered by a signal on TradingView

The Message contains the Guid which is a unique code identifying your strategy, as well as the coefficient to be multiplied:

{"Guid":"e168353f-48d1-4eb9-83ba-d5064799c7d5","PositionSize":"3"}Each time TradingView receives the alert you created, TradingView will send Wall Of Traders the action to trigger that trade. The position size will be the one defined on Wall Of Traders multiplied by the coefficient, in our previous example by 3. If you put a negative number, it will put a Short position.

Let’s see examples, with the “Part of my capital” set to Smart Trading at 5%:

{"Guid":"8311b5b2-f7c1-46d2-a459-845a9b25c68d","PositionSize":"1"}

=> Long of 5%.

{"Guid":"8311b5b2-f7c1-46d2-a459-845a9b25c68d","PositionSize":"-1"}

=> Close the previous position and place a 5% short order.

{"Guid":"8311b5b2-f7c1-46d2-a459-845a9b25c68d","PositionSize":"0"}

=> Close the entire position.

{"Guid":"8311b5b2-f7c1-46d2-a459-845a9b25c68d","PositionSize":"10"}

=> Long of 10*5% = 50%.

{"Guid":"8311b5b2-f7c1-46d2-a459-845a9b25c68d","PositionSize":"10"}

=> Do nothing because we already have the same position size.

{"Guid":"8311b5b2-f7c1-46d2-a459-845a9b25c68d","PositionSize":"5"}

=> Close half of the previous position, resulting in a Long of 25%.

{"Guid":"8311b5b2-f7c1-46d2-a459-845a9b25c68d","PositionSize":"-6"}

=> Close the previous position, and place a Short of -6*5% = 30%.

{"Guid":"8311b5b2-f7c1-46d2-a459-845a9b25c68d","PositionSize":"-3"}

=> Close half of the previous position, resulting in a short of 15%.

{"Guid":"8311b5b2-f7c1-46d2-a459-845a9b25c68d","PositionSize":"1"}

=> Close the previous position and place a 5% Long order.

{"Guid":"c8c14351-1701-4df0-9232-fa36fe90a89b","PositionSize":"1"}

=> Attention here the Guid has changed, so it applies for another trade. Let's imagine that this trade was set on Smart Trading with a capital part of 4%. So we start by opening a Long position of 1*4% = 4%.

{"Guid":"c8c14351-1701-4df0-9232-fa36fe90a89b","PositionSize":"2"}

=> Open another Long of 4%, to obtain a position of 8%.

{"Guid":"c8c14351-1701-4df0-9232-fa36fe90a89b","PositionSize":"3"}

=> Open another Long of 4%, to obtain a position of 12%.

{"Guid":"c8c14351-1701-4df0-9232-fa36fe90a89b","PositionSize":"2"}

=> Close the 1st order (FIFO), to obtain a position of 8%.ACCUMULATION: to create a trade with an increase/decrease in position, triggered by a signal on TradingView

Two possible choices for the message:

{"Guid":"e168453f-48d1-4eb9-83ba-d5064099c7d5","SidePosition":"Buy"}

=> to increase position size

{"Guid":"e168453f-48d1-4eb9-83ba-d5064099c7d5","SidePosition":"Sell"}

=> to decrease position sizeLet’s see examples, with the “Part of my capital” set to Smart Trading at 5%:

{"Guid":"8311b5b2-f7c1-46d2-a459-895a9b25c68d","SidePosition":"buy"}

=> Place a 1st Long position of 5%.

{"Guid":"8311b5b2-f7c1-46d2-a459-895a9b25c68d","SidePosition":"buy"}

=> Place a 2nd Long position of 5%, result we have a Long position of 10%.

{"Guid":"8311b5b2-f7c1-46d2-a459-895a9b25c68d","SidePosition":"sell"}

=> FIFO (First In First Ou): Close the 1st position, result we are left with a Long position of 5%.

{"Guid":"8311b5b2-f7c1-46d2-a459-895a9b25c68d","SidePosition":"buy"}

=> Place a 3rd Long position of 5%, result we have a Long position of 10%.

{"Guid":"8311b5b2-f7c1-46d2-a459-895a9b25c68d","SidePosition":"sell"}

=> Close the 2nd position, result we are left with a Long position of 5%.

{"Guid":"8311b5b2-f7c1-46d2-a459-895a9b25c68d","SidePosition":"sell"}

=> Close the 3rd position, result we are no longer in position.

{"Guid":"8311b5b2-f7c1-46d2-a459-895a9b25c68d","SidePosition":"sell"}

=> Place a short position of 5%OVERRIDE: to overwrite the values of the Smart Trading by those of the Message

In the Message, you can define other values in order to overwrite the Smart Trading values if these no longer suit you temporarily. For example you can write:

{"Guid":"ad35c4e3-fc02-42e1-a818-07e8626add47","Pair":"BTC-USDT","EntryPrice":1200,"Side":"long","Leverage":10}Regardless of the Smart Trading values, those of the Message will be applied. You can redefine all, some or none of these variables:

Pair : the pair to trade

Pourcentage : between 0 and 100 for the Entry Capital part

Side : long or short

Leverage : the leverage between 1 and 125

EntryPrice : to set an entry limit price

Trade management

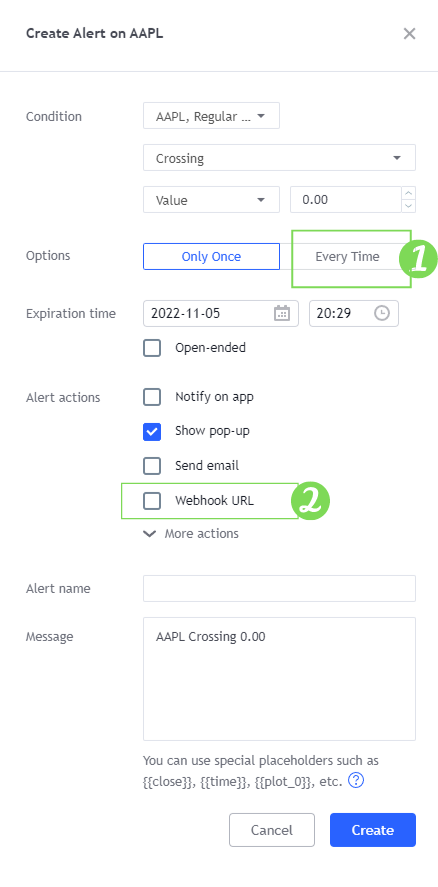

Once the type is selected, copy the Webhook URL along with the Message which you will paste directly into TradingView, in the “Webhook URL” tab in the “Alert” tab, as seen below.

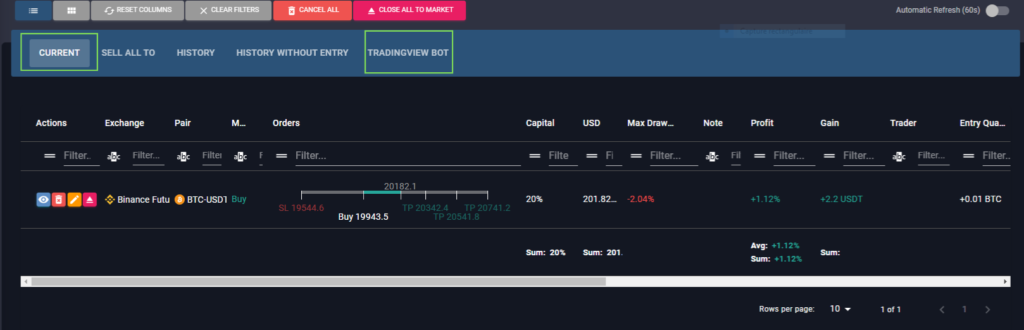

Then click “CREATE TRADE”. To find this trade and modify it or close it in advance, you can find it in the “My Trades” menu of Wall Of Trades. It will be in “In Progress” if you chose the “Only Once” option. It will be in “Bot TradingView” if you have chosen the “Each time” option.

Create your alert on TradingView

To use a TradingView alert on Wall Of Traders, all you need to do is create a TradingView account. Once on the Home Page, click on “ product “, then “ graph+ “. To learn how to use them, you can read our article on the trading indicators.

When this is done you should see a graph representing the course of a cryptocurrency, which you can of course change as you wish.

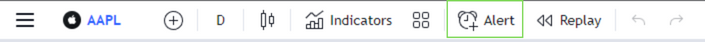

Then click “ Alert ” located at the top of your screen, the alert set-up tool should then open. Once this is done you must create your alert, for example a price alert on Bitcoin resistance, or a RSI crypto alert.

If you want to be notified each time this resistance is reached, click on “ Every time “. This feature will allow you to create a bot. This bot will notify you each time the signal is reached. If you want the alert to go off only once, hold “ Once only “. This feature will launch a single trade. The “Every time”/”Only once” setting must be the same on Wall of Traders and TradingView.

Remember, you had in the Wall Of Traders Smart Trading copy a URL and Message meant for TradingView. Paste Webhook URL as well as the message in the fields below.

Conclusion

In conclusion, utilizing TradingView alerts on the Wall Of Traders platform provides traders with the ability to automatically create trades based on signals generated by customizable TradingView technical indicators. These alerts can be set up for various conditions, such as bullish crossovers, trend lines, or specific indicators.

Through the integration between TradingView and Wall Of Traders, traders can receive real-time alerts via immediate push notifications, text messages, or webhook URLs, enabling them to make quick and responsive trading decisions. The alerts can be tailored to each trader’s preferences, offering maximum flexibility.

When the price or indicator reaches the predefined level, the alert is triggered, and the trade is automatically created on Wall Of Traders. This saves time and effort for traders, as they can focus on market analysis rather than manual trade execution.

TradingView alerts also offer advanced trade management, allowing traders to set specific trading strategies such as precise positions or position adjustments based on the alert trigger conditions. Additionally, traders have the option to override Smart Trading values with those from the message, providing additional customization.

Benefit from efficient automation

By utilizing TradingView alerts on Wall Of Traders, traders can benefit from efficient automation and increased responsiveness to trading opportunities. Bullish crossovers, indicator alerts, and the various notification options provide traders with added flexibility and convenience in their trading experience.

In conclusion, TradingView alerts enable traders to automate their trades using signals generated by TradingView’s technical indicators. Push notifications, immediate alerts, and different notification options give traders the ability to quickly respond to market conditions. Bullish crossovers, trend lines, and other trigger conditions can be utilized to create customized alerts based on individual needs. With the automatic trade creation functionality, traders can maximize their efficiency and responsiveness when using the TradingView interface on Wall Of Traders.

And now you know how to trigger a trade automatically from a TradingView alert! We hope you have enjoyed this article. Feel free to share it around you. Happy trading everyone!

This article is not investment advice. Do your own research before investing in the cryptocurrency market.