Cryptocurrency Trading is a science and a way to make money that is available to anyone who has a smartphone or computer connected to the Internet.

In a nutshell, one could define cryptocurrency trading as analyzing a financial market in order to buy low and sell high while minimizing the risk of loss.

For this, two major forms of analysis exist: fundamental analysis and technical analysis.

As the cryptocurrency market is not regulated, it is important to know its specificities and the common practices that take place there.

We will give you at the end of this article the best advice to trade Cryptocurrency while sleeping on your two ears.

Once you are ready to trade, we invite you to create an account on the 100% free Wall Of Traders crypto trading platform.

At the bottom of this page, you will find a link to the complete presentation file of this very intuitive platform which offers: a Portfolio, Smart Trading tools, Copy Trading, and a Telegram Notifications Bot.

Chapters

The Vocabulary of Cryptocurrency Trading How does trading in the cryptocurrency market work? The two main methods of analysis for cryptocurrency trading Fundamental analysis Technical analysis The risks of trading cryptocurrency Insider trading The Pump & Dump Market manipulation by whales Tips for Trading the Cryptocurrency Market Keep a cool head Have a good risk management Don't go out too late Don't look for the perfect strategy Advanced Trading Techniques DCA - Dollar Cost Averaging Arbitrage Market making How to become a Crypto Trader for the Copy Trading?

The Vocabulary of Cryptocurrency Trading

In this part, we will explain in detail the cryptocurrency trading lingo that is used in Smart Trading. Essential prerequisites, these concepts may be trivial for some but very useful for others.

We will see the different types of orders: limit orders, market orders, OCO (Order Cancels Order) orders.

Then we will learn the difference between Buy (Long) and Sell (Short) mode.

Finally we will talk about pair, leverage, Take Profit and Stop Loss.

Finally, we will show you what a Trailing and a Trigger Threshold are.

Click on the title above “The Vocabulary of Cryptocurrency Trading” to access the full article.

How does cryptocurrency trading work?

A market is the collection of long and short positions for a given pair. A pair are two assets that we will trade together, for example Bitcoin against Tether, or on the traditional markets Euro against Yen, Amazon stock against Dollar.

On the one hand there are the bears who want the price to fall and on the other side there are the bulls who want the price to rise.

This name comes from the fact that when they fight, the bears claw up and down so with a bearish movement while the bulls to plant their horns make a movement from the bottom up so with a bullish movement.

Ah because there are traders who want the price to fall? Of course !

On the one hand if I feel like buying Ripple but find the price too high right now, I will sell my current Ripples hoping the price drops to buy lower.

On the other hand, if I am short, which means, I bet on the downside, the more the price of the crypto goes down, the more I will win!

Conversely, if I am already in a position on a pair that I have already bought, then we say that I am long, because I hope that the price will increase to resell more expensive and cash out winnings.

The two main methods of analysis for cryptocurrency trading

Two major methods of analysis are used, often in conjunction: fundamental analysis and technical analysis.

Of course, neither of these two methods is a sure winner, but the more time a trader spends doing these analyzes, and the more experience he has, the more likely he is to reap the gains.

Technical analysis is suitable for all types of cryptocurrency trading. Especially for scalping which is trading over a few seconds to a few minutes, or for day trading. Technical analysis will also be suitable for swing trading over a few days, where fundamental analysis begins to be able to be used as well.

Fundamental analysis is more suited to medium-term trading, i.e. looking at units of time per day or week, or long-term trading, i.e. looking at weekly or monthly time units. For these two types of medium and long term trading, technical analysis is also exploitable.

For those who do not have the time or the inclination to learn cryptocurrency trading, they can do Copy Trading, which means automatically copying the positions of the best Traders to their account. The Wall Of Traders trading platform offers free Copy Trading thanks to a partnership with Binance which pays fees.

Fundamental analysis

Fundamental analysis is the act of analyzing the psychology of the market in order to determine whether the predominant mood is fear and therefore the sell and fall of the market, or if it is rather excitement and therefore the purchase and the rise in prices.

The goal here is therefore not to analyze the graphs, prices and volume to know how the market behaves mathematically.

The goal is to analyze the general state of mind of other traders. Indeed, it is all the traders who will move the market in one direction or another.

Fundamental analysis is based primarily on news from the relevant market. If for example Vitalik Buterin, the creator of Ethereum, makes an announcement saying that he is withdrawing from the project because he no longer believes in cryptos, the price will drop sharply because the majority of traders will decide to sell.

This is a crude example for understanding the mechanism of market psychology analysis. A good trader reads financial news daily to see if a particular asset has a future ahead of it, or if it risks taking losses.

The correlation between the different markets is also to be taken into account. A major economic crisis like the one following the Covid-19 pandemic massively impacted the traditional financial market, then massively impacted all cryptocurrencies. Once this fear was over, the markets started to take color again.

Technical analysis

We have written a full article on technical analysis with the presentation of the main technical indicators and main chart figures. Just click on the title just above “Technical Analysis”. We will also talk about Price Action Trading.

Technical analysis, also called graphical analysis, consists of analyzing the graph of the change in the price of an asset or a crypto over time.

This analysis is done using mathematical tools called technical indicators, or using models of geometric figures that can be found from one graph to another, called chartist figures.

A technical indicator is a mathematical model by which we can predict the evolution of the price. For example, if the indicator exceeds a value X, it predicts a trend reversal, while if it crosses a value Y, it predicts a trend confirmation.

As these are quantitative indicators, this technical analysis work can very well be done by trading robots. The trader develops algorithms based on these indicators and the IT developer then creates the trading bot: if the indicator crosses such a value, then he buys or he sells.

Technical analysis can be used on any time scale, whether we look at the second, the minute, the hour, the day, the week, the month, the year or even the 10 years.

The risks of cryptocurrency trading

In the cryptocurrency market, there is virtually no regulation. What is illegal in traditional markets is not necessarily illegal in active crypto markets. The biggest exchange is Binance.

Here are three techniques that are allowed in the crypto market when they usually carry heavy fines or even jail time in traditional markets.

Insider trading

Insider trading is the strategy of owning confidential information and using it to your advantage to gain market profits. For example, if I know before anyone else that a certain company is going to go bankrupt, I will sell my shares. This is prohibited if all investors are not aware at the same time. In the crypto market, this insider strategy is commonplace.

The Pump & Dump

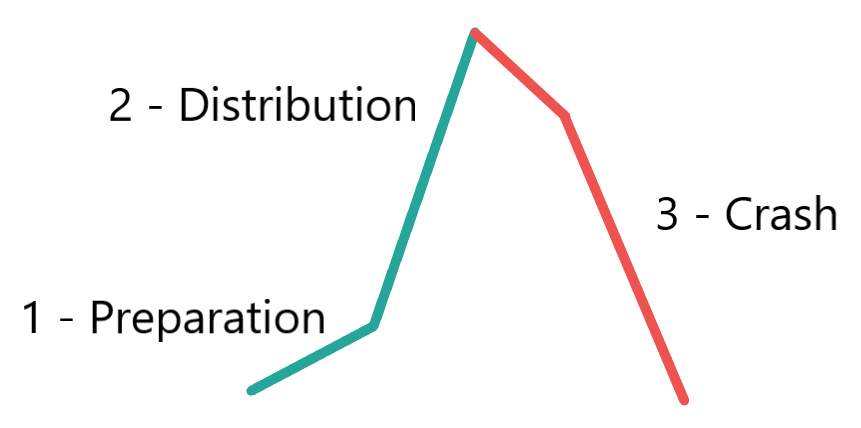

Pump & dump is the act of artificially inflating prices to make the market appear to be rising, then reselling to newcomers as high as possible.

Step 1: The Pump. Scammers will buy a large amount of assets at some point, thus inflating the market price, so that investors flock to this deceptively promising market. As new cash is invested in this market, the price continues to inflate.

Step 2: The Dump. When the rise begins to run out of steam, scammers who are on the lookout then massively resell their initial stake. This helps to reverse the trend which becomes bearish. Investors then panic and also resell. The price returns to the starting level.

Bottom Line: Scammers bought low and sold higher, while investors bought high and sold lower. There is a transfer of assets from investors to scammers.

Tip: Never invest in a pair that has very little volume and suddenly sees huge volume coming in, causing its price to rise artificially. This is not going to last! The pump & dumps are very fast, they last from a few seconds to a few minutes. So don’t set foot in it, only the pump & dump organizers are the winners! It’s a scam.

Market manipulation by whales

A whale is the holder of a considerable amount of assets. For example for Bitcoin, it is estimated that 1000 investors own 40% of all Bitcoin in circulation! It’s enormous.

So each of these whales has an average of $ 50 million worth of BTC.

A whale, or an association of several whales, can manipulate but also support the market.

Manipulating because by buying excessively, they will artificially inflate the price. Lambda investors see the price rise and are afraid to miss this new wave. They therefore enter the market by giving in to FOMO: Fear Of Missing Out. But soon after investors arrive, the whales sell high, causing the market to fall. It’s a bit like pump & dump but over much larger time units.

Stop Loss hunting

Another type of manipulation is Stop Loss hunting. Stop Loss Limits are public on exchanges. By analyzing the positions and their volume, you can see where most of the Stop Losses are located, usually just below a Support. The whales will sell massively to bring the price down and hit Stop Losses, but as soon as they are hit the whales buy, which drives prices up. Stop Losses were hit for nothing as the price rose again, leaving investors without a position in the market! And the whales bought low.

On the other hand, whales support the market, repositioning their pawns when the market collapses. This happens especially during periods of FUD: Fear, Uncertainty, Doubt for fear, uncertainty and doubt. Most investors pull out their cryptos thinking the market is going to collapse. By doing this they contribute to the price falling, causing a cascade of other investors to withdraw from the market. Whales invest regularly to keep the market going and prevent the price from approaching zero. After the bubble burst at the end of 2017, this was the case.

Tips for Trading in the Cryptocurrency Market

Keep a cool head

You should never trade with your emotions. Concretely, this means that you have to have a trading plan and stick to it. You should only enter a market if you know it and have studied it. In particular, you need to know in advance when you exit the market in terms of take profit or loss (Stop Loss).

These levels do not have to be changed manually, it is time consuming, stressful and most of the time a decision made in a hurry will cost you money.

You can use the very powerful Trailing function offered by the Wall Of Traders trading platform, so that the Take Profit and Stop Loss vary automatically according to the market price and thus make larger gains and smaller losses.

Have good risk management

Don’t bet everything on the same trade. Even the best trader in the world will have losing trades several times in a row. It is good practice to bet between 1% and 10% of your total capital per trade. If you lose, don’t give in to the temptation to increase your equity percentage on the next trade to get yourself back.

The percentage of capital should depend not on other past trades but on the probability of winning that trade. The more chances you think you have of winning, the bigger you bet, but without going over 10%.

On exchanges that offer leverage like Binance Futures, Bitmex or Kraken for example, use leverage with mastery. Do not exceed x20 which is already a very big leverage.

Prepare to take losses. With good risk management this shouldn’t scare you. Indeed no one knows the future. All of the best technical and fundamental analysis in the world can be disrupted by whales deciding to manipulate the market.

Don’t go out too late

Consider putting a Stop Loss. Better to voluntarily exit a loss-controlled market, rather than suffer a monstrous loss due to no Stop Loss. Remember, the cryptocurrency market is very volatile. Tomorrow the price may be 10% lower. Don’t come out of a losing position too late.

When your Take Profit has been reached and the price continues to rise, do not re-enter this market! There is a good chance there will be a quick trend reversal. The cryptocurrency market is very responsive. A nice rise is often followed by a nasty correction.

Don’t look for the perfect strategy

Remember, it is impossible to enter and exit at the best time in the market, because these two times are unique. It should have been purchased in 2009 for $ 0.0008 and resold in 2017 for $ 19,783, or in 2021 for $ 58,000 (at the time of writing).

More generally, it is very difficult to optimize the right time to enter the market. Avoid “time the market” by expecting too much. If you believe in a market, do your analysis and get started.

The adage “Trees do not rise to the sky” always holds true in finance. Even if in the long term the curve is increasing, in the medium term an increase is always followed by a correction. If the rise is too steep, it is called a speculative bubble, and it is always followed by a crash.

So don’t believe all those traders who tell you “to the moon” because before you reach the moon you will crash into the ground several times, and it is very likely that you will not financially support these falls.

If your strategy is HODL, which is to buy once, and wait a long time to resell, stick to that strategy. Your only two goals are then: to be patient and find the best time to sell.

Advanced techniques of cryptocurrency trading

DCA – Dollar Cost Averaging

DCA consists of regularly buying small quantities to smooth the entry price.

Let’s take for example a capital of 1000€ that you want to invest to buy Bitcoin. If you buy all of a sudden today, you might miss out on any bitcoin decline that may take place tomorrow. To avoid this, you can choose to buy €100 every day at the same time for 10 days. This is a very simple example of DCA.

To go further, click on the title of this sub-chapter.

Arbitrage

Arbitrage consists of buying an asset on an exchange platform to resell it for a higher price on another exchange platform where the price is not the same.

Many trading robots already do this automatically on most financial assets and cryptocurrencies, so unless you have very large capital to lower trading costs, it is very difficult to arbitrate on popular markets like cryptocurrency.

Market Making

Market Making is reserved for very large capital. They will put buy and sell limit orders at different levels to make sure they are met by investors. Market Making is often done using robots.

For example on cryptocurrency, one technique is to go to small, little-known exchanges, as there are everywhere, especially in eastern countries. On these exchanges, liquidity is low, so there are few potential buyers and sellers.

On these small illiquid exchanges, the order book has a gap between the highest limit buy price and the lowest limit sell price. It is enough to put positions in this void to be sure that they are filled first. And in this vacuum the prices are very interesting for those who set limit orders.

Let’s simplify this example as much as possible: there are long positions at 45500, 46000 and 46500. There are short positions at 48000, 48500 and 49000. All you need to do is place buy limit orders above 46,500 and sell limit orders below 48,000 to be sure you are the first to have your order filled by future buyers and sellers.

If another buy limit order is placed above ours, or a sell limit order is placed below ours, our trading robot will automatically modify our positions to be in first position.

How to become a Crypto Trader for the Copy Trading?

Anyone can create a Copy Trading group so that their family, friends, other own Binance accounts or community automatically receive all their trades on the exchanges of their choice.

To do this, nothing could be simpler, read the article by clicking on the title above. And what’s more, it’s 100% free!

We hope you enjoyed this article and now have a good foundation to start trading in the cryptocurrency market.

Share it with others and support us by sharing it on the social network of your choice and sending it to your contacts who might be interested.

Write a comment to share your experience, we will answer all your questions.

We recommend reading our article on the full presentation of the free Crypto Trading Wall Of Traders platform.

This article is not investment advice. Do your own research before investing in the cryptocurrency market.