Binance Futures recently launched its Leaderboard. It allows users to follow the most successful traders on its social trading platform. Using the information in this ranking, the copy traders can easily find the most profitable traders and follow their positions in real time.

In this article, we will explore the benefits of Binance futures leaderboard, discuss the risks of copying traders, and analyze the performance of some of the most successful traders on the platform.

Discover Wall Of Traders, a 5-year-old trading platform that launched its automatic copy trading tool for traders’ positions from Binance futures Leaderboard. The platform is 100% free thanks to the fact that Binance futures gives them part of the trading fees.

Additionally, if you have a community, you can even provide them with the Trader of your choice!

The Binance Leaderboard: What is it and how does it work?

The Leaderboard is a ranking of the best traders of Binance Futures. Traders are ranked according to their profit made over a period of 30 days. The leaderboard is updated hourly and allows users to see traders’ open positions, their followers, and the signals they give.

Platform users can copy the trades of local traders top ranked using the Copy Trade feature through TraderWagon, which levies taxes on profits. If you don’t want to pay taxes, use the platform Wall Of Traders. It allows to automatically follow the positions opened by the selected traders.

However, it is important to note that the copy trading includes risks and should be done with care. Let us now look at some of the best traders from Binance futures.

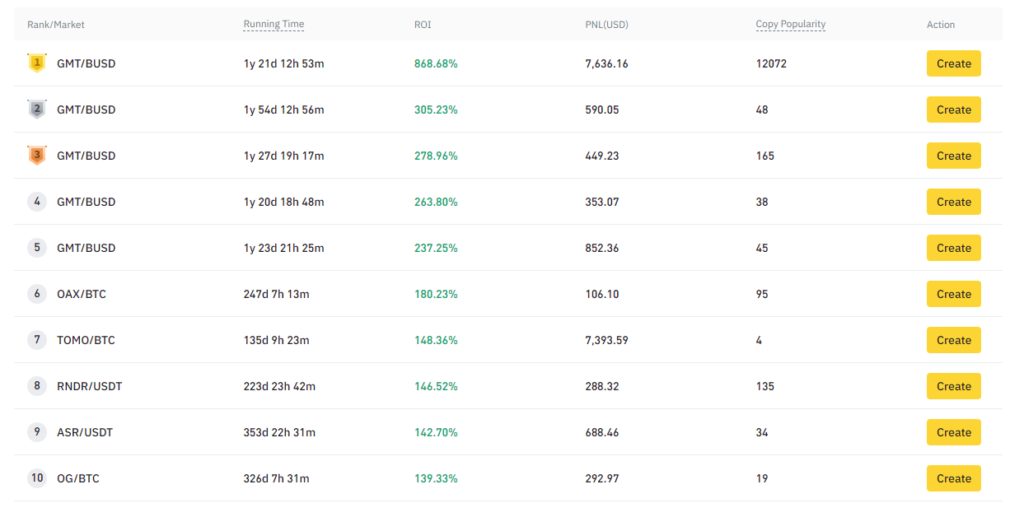

To compare open positions, scrape positions, and engage in automated trading, you can use the maximum number of position trends available on the Binance Futures Leaderboard. The Binance Futures Leaderboard URLs provide access to the source code for fetching open positions and popular positions of the listed traders. With advanced filters, you can narrow down your search based on specific criteria.

It is crucial to approach copy trading with caution and conduct thorough research before following traders on the Binance Futures Leaderboard. Keep in mind that past performance is not indicative of future results, and it’s essential to consider your own risk tolerance and investment goals.

By leveraging the tools and features offered by Wall Of Traders and the Binance Futures Leaderboard, you can enhance your trading experience and potentially improve your chances of success as a copy trader.

Wall Of Traders, a free solution to copy traders from u Binance Leaderboard

Wall Of Traders is a completely free copy trading platform thanks to their partnership with Binance Futures and its Binance Broker Program. WOT automates the signals sent by Binance futures traders. Whereas TraderWagon platform charges fees on transactions, Wall Of Traders does not charge any fees for copiers.

By using Wall Of Traders, copiers can access a wide range of experienced traders including those on the Binance platform. They can choose which transactions they want to copy based on their trading strategies. But also their return and their level of risk. Copiers can also set their own settings for risk management. For example, the percentage of their capital that they are willing to invest in every transaction.

By choosing Wall Of Traders, copiers benefit from a completely free and easy-to-use platform to copy the trades of experienced traders. This without having to pay additional fees for each transaction.

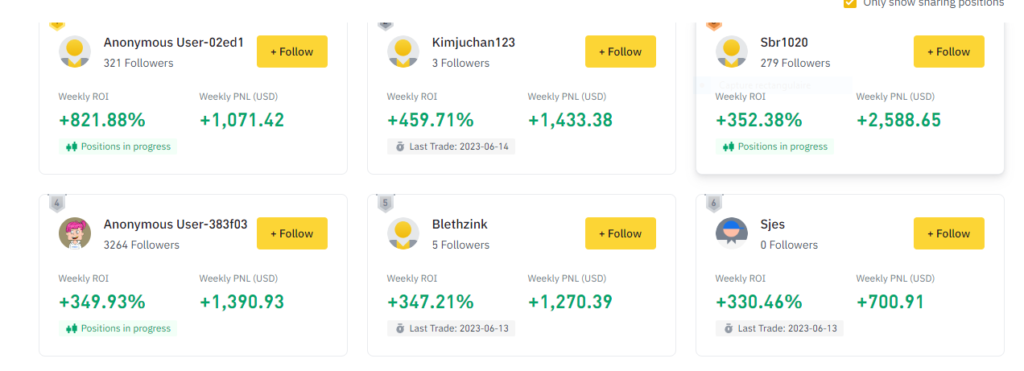

Some of the best Leaderboard traders Binance

Now that we have covered the basics of copy trading. For that, let’s take a look at some of the best traders in the Binance Futures Leaderboard.

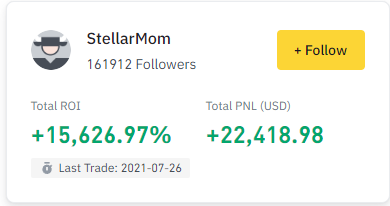

StellarMom

NguyenDinhTamBkhn

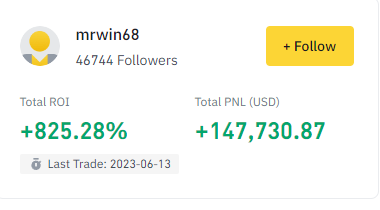

mrwin68

RosePremiumSignal

Risk Management: a key element of copy trading

As copy traders, when you copy a trader’s trades, you are also copying their Risk Management. It is therefore important to choose a trader who applies a consistent and prudent risk management strategy.

It is also important to set your own risk limits before you start copy trading. You need to determine the maximum amount you are willing to lose on a single position and the maximum amount you are willing to risk by copying trades from a single trader. But that’s not all there are other ways to limit your risk of loss such as performance consistency.

Regularity of performance: a quality indicator

When choosing a trader to copy, the consistency of their performance is a key indicator like dollar cost averaging of their quality. Traders who have stable and consistent performance over a long period of time are more reliable than traders who have punctual but irregular gains. They will therefore be more interesting for your trade.

The Maxdrawdown: a measure of risk for copy traders Binance Leaderboard

The Maxdrawdown is a measure of risk that represents the biggest loss the trader has suffered since the start of their trading history. It is important to consider this measurement when choosing a trader to copy. It indicates the level of risk you may encounter by following its trades.

Performance monitoring: how to measure the success of your copy trading?

Once you have chosen a trader to follow and started copying their trades. It is important to measure your own success by its performance.

The first step is to assess the profitability of your portfolio based on the copied trades. If the trader you have chosen is performing well, it is likely that your wallet also shows gains.

However, it is also important to consider trading fees. These fees may have a significant impact on your earnings and should be taken into account when evaluating the profitability of your portfolio.

Additionally, it is important to follow your own risk limits and monitor your portfolio regularly. In order to ensure that you are not exposed to excessive losses.

Finally, it is important to track the performance of your chosen trader at regular intervals. If his performance begins to decline or if he takes riskier positions. It may be wise to reconsider your decision to follow him.

By following these basic principles and exercising due diligence in choosing and following a trader, you can improve the chances of your trade succeeding on Binance Futures.

Conclusion

The Leaderboard is a useful tool for users who want to copy the trades of the best traders on the platform. However, it is important to take into account the principles of risk management, regularity of performance, and Maxdrawdown for your copy trading.

Ultimately, it is essential to remember that copying trades involves risk and past performance is no guarantee of future performance. It is important to do your due diligence and consider all relevant factors before deciding to follow a trader.

By using the Binance futures leaderboard and following the principles of risk management, performance consistency, and Maxdrawdown, users can improve their chances of success trading Binance Futures.

If you want to know more about copy trading and how to take advantage of the Binance Futures Leaderboard, go to the site of Wall Of Traders and explore the many tools and resources available to cryptocurrency traders.

The provided list on the Binance futures leaderboard offers valuable insights into the possible places where top traders can be found. By utilizing advanced filters, users can sort users based on various criteria such as performance, risk, and trade frequency.

Facilitate Copy Positions and Engage in Automated Trading

To facilitate copy positions and engage in automated trading, the platform employs automated trading algorithms. The symbol entry price, along with relevant rank information, is used to send signals and execute trades. The active development of the platform ensures that the actor is constantly updated and optimized to run blazing fast.

To manage the amount of data retrieved, users can limit scraped users and define the maximum number of traders to follow. By observing position trends and considering factors such as total item count and Maxdrawdown, users can make informed decisions when selecting traders to follow.

The actor responsible for scraping and processing data from the Binance futures leaderboard URLs efficiently stores results for further analysis. The output messages provided by the actor assist users in monitoring their copied positions and make necessary adjustments.

With a focus on active development and continuous improvement, the Wall Of Traders platform aims to provide an optimal copy trading experience. Traders can benefit from the advanced filters, automated trading, and the wealth of information available on the platform.

By following the principles of risk management, utilizing the Binance futures leaderboard, and leveraging the tools offered by Wall Of Traders, users can enhance their copy trading strategies and improve their chances of success in the cryptocurrency market.

Chances are you will also enjoy our other articles covering key cryptocurrency information. Here are some examples: “Binance Leaderboard API: What is it?“, “Copy Binance Futures Leaderboard: WOT, the tool for traders“, “Copy Binance Leaderboard: Copy trading with Wall Of Traders” and “Binance Futures Leaderboard: how to trade safely“. These articles offer interesting insights into the various features and opportunities related to cryptocurrency trading.

This article is not investment advice. Do your own research before investing in the cryptocurrency market.